THIS POST MIGHT CONTAIN AFFILIATE LINKS. MY DISCLOSURE POLICY GIVES YOU MORE DETAILS.

It’s time to audit your bank account.

By audit, I mean manually go through and look at every charge for the last six months to a year.

Why would I want to do that, you ask?

Well, it’s likely that you are NOT doing it monthly. If you are, give yourself a star and move on to the next blog post because you are a financial rockstar.

But for those of you (US, I mean US) that never do this, it’s time.

Long gone are the days when we kept track of every debit from our bank account on a check register. Now, most of us have it all digitally recorded.

We’re supposed to go through that digital record each month to make sure the charges are right. DID YOU KNOW THAT?

Also, if you’re using a Down to Zero budget, you’ll need to know exactly how much is in your account and how much you have to spend. My hunch is that you’re just letting those charges come through and, if you don’t have money, your savings account sends a little overdraft protection to your account. (Thanks, overdraft).

RELATED: Make a Down to Zero Budget

But also, no thanks. I don’t want to use my overdraft protection each month to keep the money flowing. We should be paying more attention to how much is in our account and how much we have to spend. More on that here.

An audit is for finding problems

If you’re not checking your bank account each month, you probably have some problems.

It's time to be brave and get in there to take a look. You COULD even find some free money.

Here are the issues I found when I did my bank account audit this week:

All told, I found $250 of charges that I got refunded or reversed because they were errors. I also cancelled $200 worth of subscriptions I didn’t need, or services I wasn’t using. In two cases, the services refunded several months of payments because I forgot to cancel the service.

Not bad for one hour of work.

Well, the auditing takes an hour. The cancelling and all that took more work, but I’ll walk you through all of it to make it MUCH easier.

Decide that today is your financial New Year’s Day and audit that thing so you can start fresh from here on out!

1. To audit your bank account: log in

Log in to your online bank account.

You should be using 5 bank accounts.

If you don’t have five bank accounts, you’ll start with your debit card account, the one you use the most.

You’ll need to repeat this process for all of your bank accounts, though some of them are going to be pretty quick since there’s hopefully very little activity in your savings accounts and bill pay account.

2. SCROLL!

Carve out an hour and go through all your charges. This takes a lot of scrolling backwards, and it’s a good idea not to stop in the middle because then you’ll have to start from the beginning (at least that’s how my bank account is set up).

I went back 6 months since that’s when I last did this exercise. If you have never done this, go back a year. You’ll catch all those annual charges you might forget.

TIP: If you are working on setting up a Down to Zero budget, you want to keep track of all those annual expenses so you can start saving for them all year.

3. Look for three kinds of charges

You are looking for three kinds of charges:

• mystery charges you don’t understand

• services or subscriptions you no longer want

• charges that belong in another account

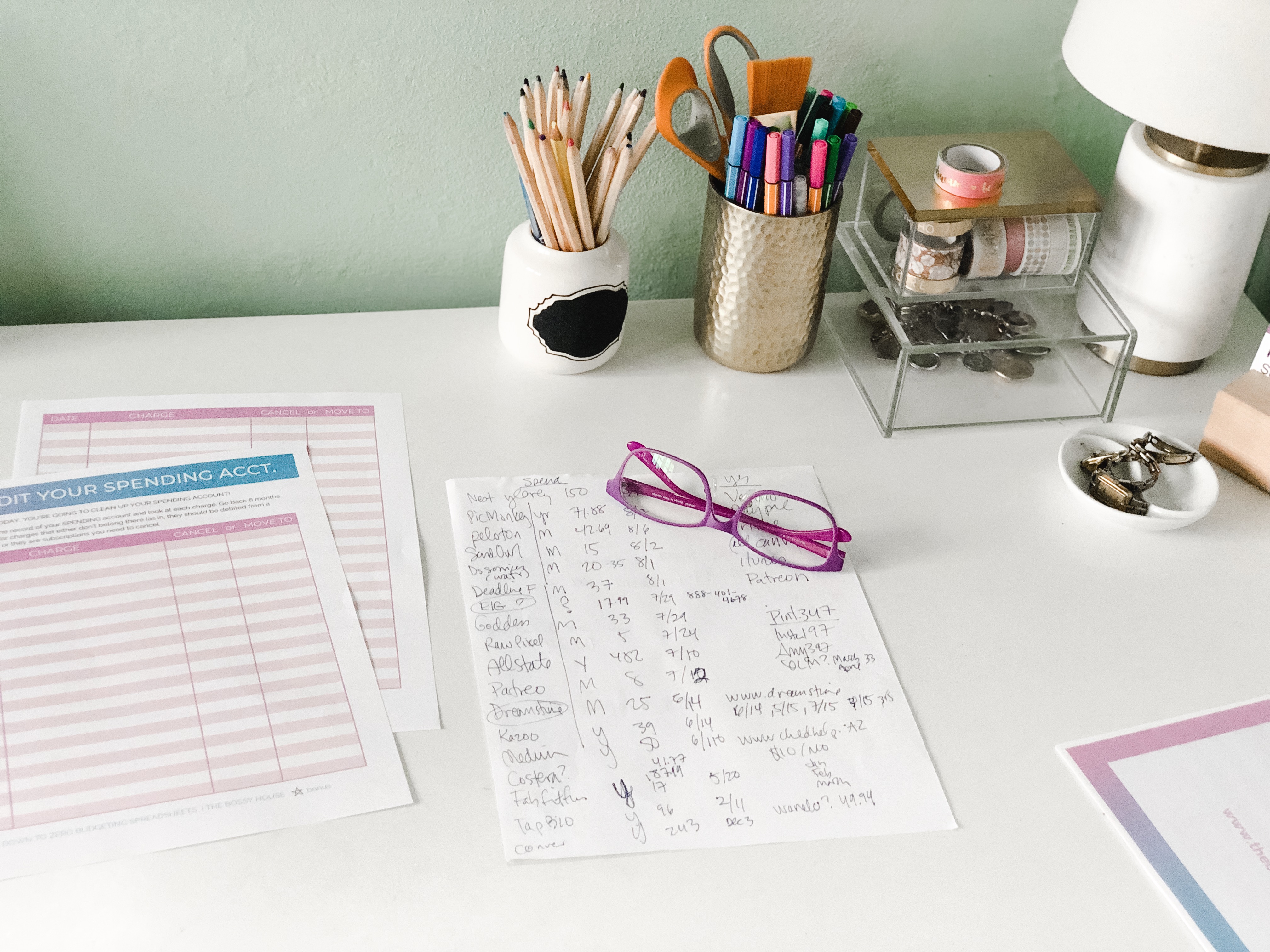

I made a list of every charge that fell into these categories, and then I indicated what needed to be done with that charge. This took about an hour.

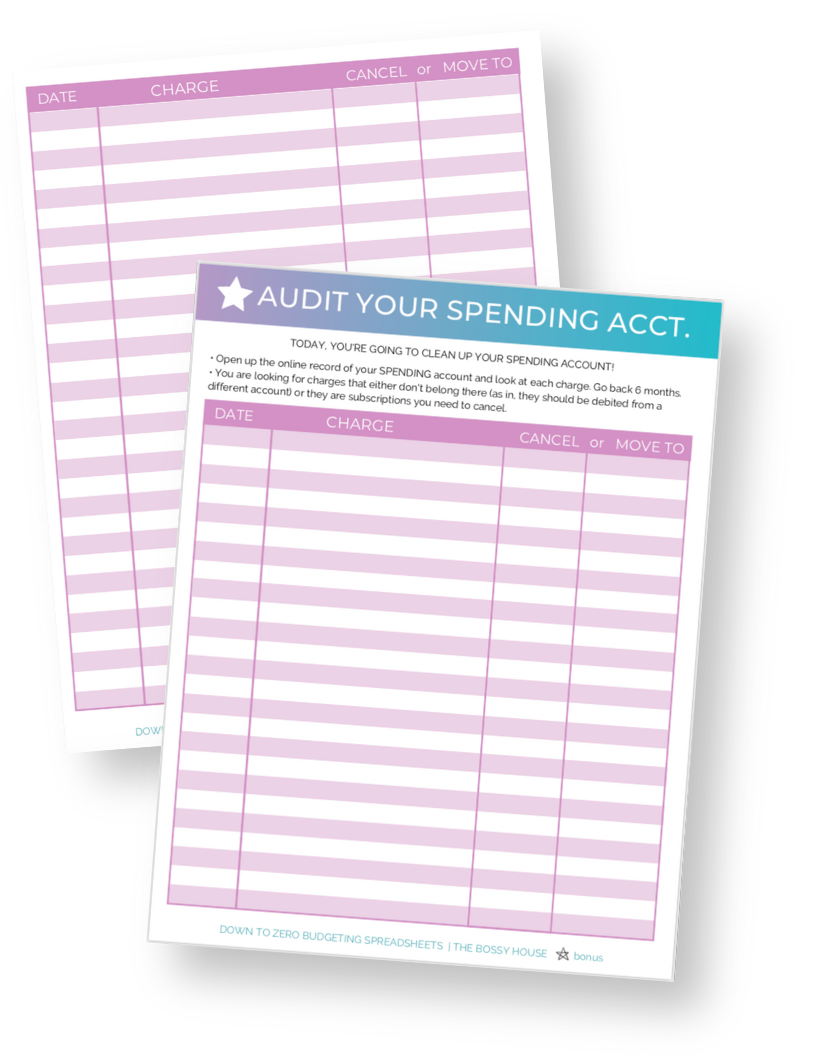

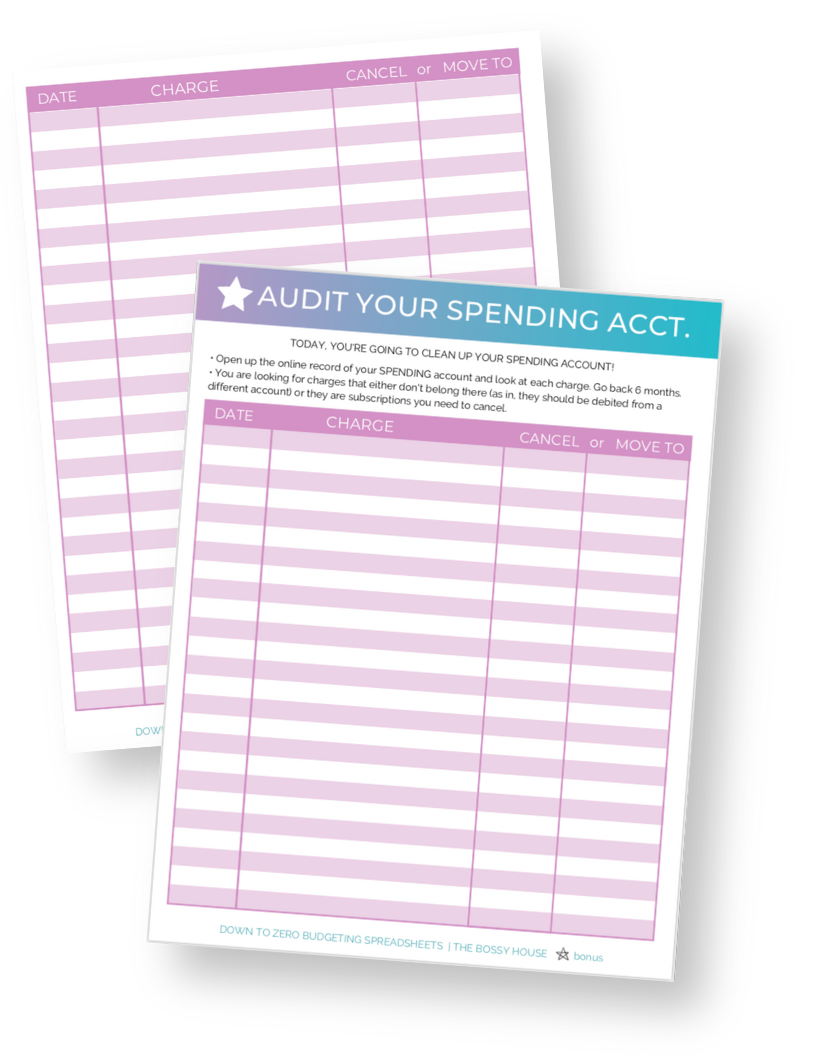

In the middle of the process, I created a new handy template that’ll allow you to get everything organized MUCH more neatly than just making a list.

On my fill-in-the-blank template, list a charge, then indicate if you want to cancel it or move it to another account.

Scroll to the bottom to download your free copy of the template.

4. Work your list

Your work’s not done. This list you just created is your to-do list. I hole punched mine (using the hole punch for my favorite organizing tool TUL) and put it in my notebook.

That way, I could work the list over the course of a couple weeks.

One day, I cancelled an unnecessary subscription box, another day I called the bank about a potential fraudulent charge. As I finished an item, I crossed it off the list.

All the items that are marked “MOVE TO” should be moved to other bank accounts.

Which of these is better, the list on the right or the fresh template on the left? Get your template below!

For instance, I had my monthly Peloton charge coming out of my spending account. When I purchased it, I probably just used my debit card because I could remember that one.. But that monthly charge should really come out of my monthly bill pay account.

So I went online to my Peloton membership account and changed the account. I then went and updated my financial spreadsheets to make sure that I’m putting enough money in that account each month.

These spreadsheets auto-populate and allow me to add in charges like this really easily. You can find out all about these fancy spreadsheets here!

There you go, you’re all set with your bank accounts fresh and ready for the next six months. Oh, and it won’t kill you to note a few spending goals you have while you’re at it. You probably noticed WAY too many Postmates charges. Or is that just me?

Get this handy Template to Audit Your Bank Account. Give yourself one hour to find some free money!

These are great tips, the closer I get to retirement, the more I want to know every dime we spend. I will have to check this out!

Awesome, Kathy. And good luck!

This is a real helpful post! I usually trust the bank personnel to handle my accounts, but I guess I should take a closer look this time for charges I am not aware of.

Trust but verify, right? 🙂

Auditing bank account monthly is so very essential and also the credit card statement. I developed this habit very early in life and it surely helps. Nice post.

Thanks!

Thanks for the reminder! I’m normally attentive enough to these type of charges. However, if one gets busy, one just might miss an error.

Glad it helped, Shar!

I seldom check mine and you are making me want to check it sooner than I thought I would. Thanks for the info. They are pretty handy!

I hate checking too. In fact, I have to MAKE myself do it but I always fine money!

Great tips for auditing your bank account, I must admit I do check mine regularly after working in banking for many years I do know problems arise so it is one thing I am quite hot on

Good for you! I have to admit I really hate doing anything related to managing my accounts, but it’s always beneficial. Keeps me honest. 🙂

I check my bank account monthly, and it’s amazing the little things you can find in your account that you shouldn’t be charged for, you should definitely check and go through your account on a regular basis

I agree, Laura!

Ok, I like this idea! Since I am using cards, everytime I am so un-organized! So thank you the the tips. Much appreciated!

I agree– when I had only a checking system for paying bills, I kept better track of every charge. I HATED it but it meant I had to do all that work. Now, we can just print it out, so pros and cons!

That was a big amount of extra cash you got there. You gave me the drive now to check my bank accounts .Good job for you.

I KNOW I couldn’t believe it. I wonder how much you’ll find!