GET YOUR FREE SET OF FINANCIAL PLANNING TEMPLATES

This set includes the goal sheet, debt and savings tracker, weekly spending worksheet, annual expenses planning sheet, as well as a budget summary sheet.

Automating your finances is the BEST way to get free from both the financial struggles you’re having AND the monthly stress of managing your money.

The key to automating your finances is to take an honest look at your money situation and then set goals based on what's up with your financial life.

My friend Matty Sallin writes about automating your finances and how to pick your financial goals. Like, should you pay down debt first or start an emergency fund? He'll hep you decide. He's set up an incredible system (called The System) that essentially helps you put your finances on autopilot JUST LIKE I'M TEACHING YOU HERE!

After you set your goals, you should make a Down-to-Zero budget, which sends all your money to savings, debt, annual expenses, emergencies, and bill pay so you NEVER SEE your whole paycheck.

We all know that we spend what we have, so leaving JUST that amount in your spending account means you’ll spend less every month. Yes, this plan relies on tricking yourself into thinking you have less money.

But it’s worth it because you will already have met your goals and obligations for the month AND planned for surprises along the way.

You should be automating your finances because thinking about money every month is annoying, stressful, and unnecessary.

Instead, put a bunch of effort into setting up a financial plan and automating it, and you'll end the stress AND meet your goals effortlessly.

Along the way, you'll answer key questions like

Where is all my money going?

Can I afford my lifestyle?

What goals should I have?

When you make your plan and automate your finances, all you do each month is watch the money move around your accounts.

You’ll work less hard to meet your obligations, you’ll hit your goals faster, and you’ll finally achieve financial freedom for yourself.

The first thing you need to do before you automate is get really clear about your financial situation, what your goals are, and how much you can live on.

These financial planning templates are the key to walk you through your steps.

Next, you set up your bank accounts so you never see your whole paycheck again.

What does this mean?

You are going to divvy up your paycheck as soon as it hits your bank account, sending it to multiple accounts.

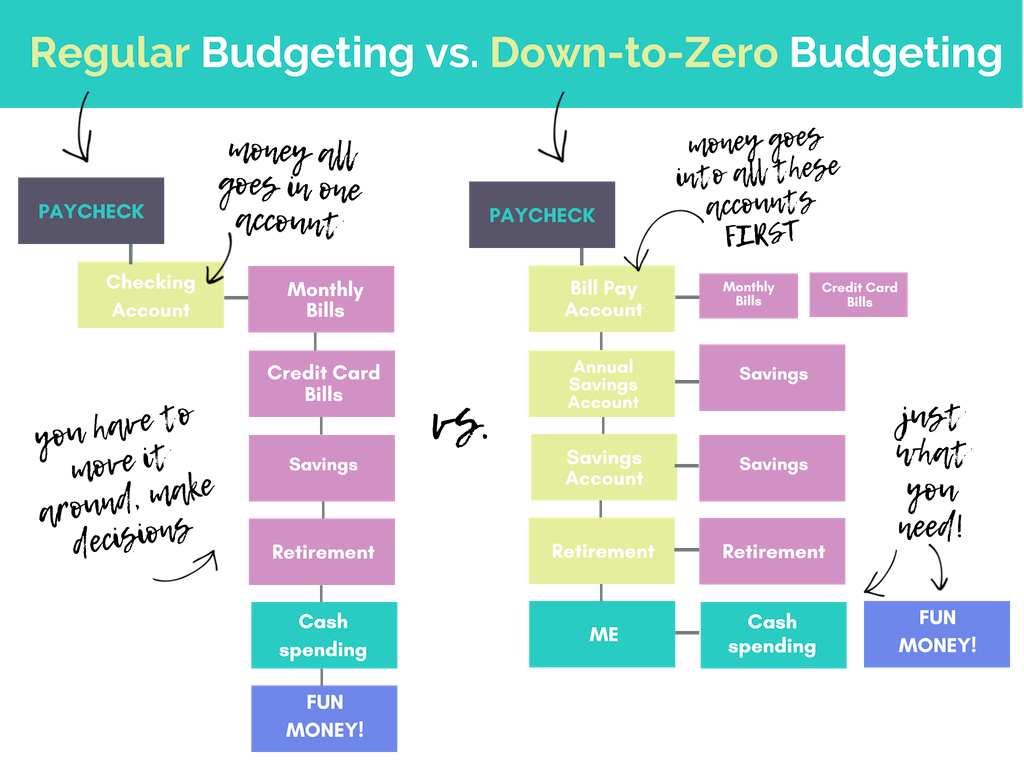

This is different than traditional budgeting because it designates every dollar in your income to a specific purpose.

In regular budgeting, money goes from your paycheck into your checking account, and you pay your bills, move money into savings, buy groceries, and maybe get a few drinks after work. If you buy too many concert tickets or overspend on groceries, you don't have enough for your monthly bills! Not to mention you might not be meeting your goals FIRST every month. Oh nooooooo!

With Down-to-Zero budgeting, money goes immediately into four accounts that are for specific purposes. What you are left with is the cash spending in your spending account, and every dollar in that account is for you to spend. Your goals are met, your bills are paid, and you're all set BEFORE the money hits your spending account.

Yes, it's more complicated this way. But only on the setup. Each month, it's actually less work. And the less thinking about your finances the better!

Most banking systems will allow you to set up multiple accounts online. I was able to take my one checking and one savings account and open up two more accounts online in about 10 minutes.

I like to have four accounts, but others might want to have five and include a savings account. This is also not taking into account what you might want to do with your retirement savings, which likely will be through your employer or another set up.

Now, you want to tell your bank exactly how and when to move the money from the spending account, where it is deposited, to the other accounts. You’re going to want to make sure that the timing is right so you have the money in the accounts you need when you need it.

Use this sheet to determine which pay periods should be used for which transfers. Depending on your situation, it might make sense to transfer the money from your spending account to your annual needs once a month or twice a month.

You might plan to move money from your spending account (where it’s direct deposited from your employer) to your bill pay account twice a month, once for each pay period. Or, you might decide to pay all your bills from the first check of the month so you only move money to bill pay one time. Your plan will be unique to your situation.

From your bill pay account, set up your monthly bill pay to take care of every monthly expense you have that you can possibly pay online.

That includes your water bill, your mortgage or rent, and your electric bill, but you pay virtually anyone online. So if you pay a gym membership each month, see if you can pay it through your bank. Same with debts to family members or recurring expenses. Most banks allow you to set up a recurring payment online for anyone with an email address.

For those expenses that are monthly but are paid through direct withdrawal (like a monthly donation to the SPCA or your Netflix bill) you will pay those from your bill pay account too.

Check out your bank statement for the last month and make sure every automated payment will come out of your bill pay account. You might have to make a lot of phone calls and online changes to accounts to make this work, but it’s worth it to have every bill paid from the same account every month.

When you’re done, you'll need to keep track of exactly which bills are paid and what date of the month they are paid. Use my template below to help you!

The first few months, you’re going to want to watch this closely and make sure all of your bills are actually getting paid. The first month is really an auditing month.

Watch those bills clear your account and cross them off. If, at the end of the month, all of your account transfers have been made on time, all of your bills are paid, and you still had enough spending money to work with, you did it!

So you’ve made a plan for that vacation you take in the summer by saving a little bit each month and transferring it in the annual savings account. Now it’s time to book the flights. What do you do?

You simply go to your online banking system and make a one-time transfer from your annual savings account to your spending account. Then you use your debit card to book the trip. Easy.

Similarly, if you have an emergency, you would make a one-time transfer from your emergency account to your spending account, then use your debit card (or write a check or withdraw the cash) to cover the emergency.

The key here is to use your own money to cover things that you might have used a credit card for. We don’t want to put money on our credit card and further delay getting debt free, so no more of that. From here on out, we’ve made a plan and we’re using our own money.

My planning sheets (below!) help you map out your whole plan so you're on the path toward financial freedom.

Just imagine it:

You've downloaded the sheets below.

You've spent an hour getting honest, setting goals, and making a solid plan.

You've taken another hour to automate all your systems so your bills are paid and your goals are met...on autopilot.

And look at you-- you're living within your means, paying all your bills on time, saving for the future, and paying down debt. And because you created such a solid plan, you'll stop accumulating new debt because of emergencies or surprise bills.

And putting it all on autopilot means never having to think about the details again except to make sure it's working properly.

That's all it takes-- TWO HOURS to get closer to financial freedom.

Session expired

Please log in again. The login page will open in a new tab. After logging in you can close it and return to this page.

Wow! Definitely helpful organizational tips. It makes you realize how much you should pay attention to your finances.

Thanks! I hope it’s helpful for you!

I am the worst when it comes to managing my finances!! I don’t know from where to start! I have bookmarked your post for future reference. thanks a lot.

Wonderful! I’ve found that once you set it up one time, it works like clockwork and you don’t have to manage too much at all!

I am definitely curious about how you would have your money sent to all those accounts. I think separating out the money right away would be good. It does help you to save money when you don’t think you have it straight away.

With most banks, you would be able to manage this online. So you set up your paycheck to go in to your Spending Account. (Usually through your employer.) Then, you’d set up your online bank account to do monthly account transfers to each of the other accounts you create. I have three other accounts. I know JUST how much money needs to go into each account each month, so it’s automated. If you download these worksheets, it’ll walk you through the whole process to figure out how much goes to each account!