GET YOUR FREE SET OF FINANCIAL PLANNING TEMPLATES

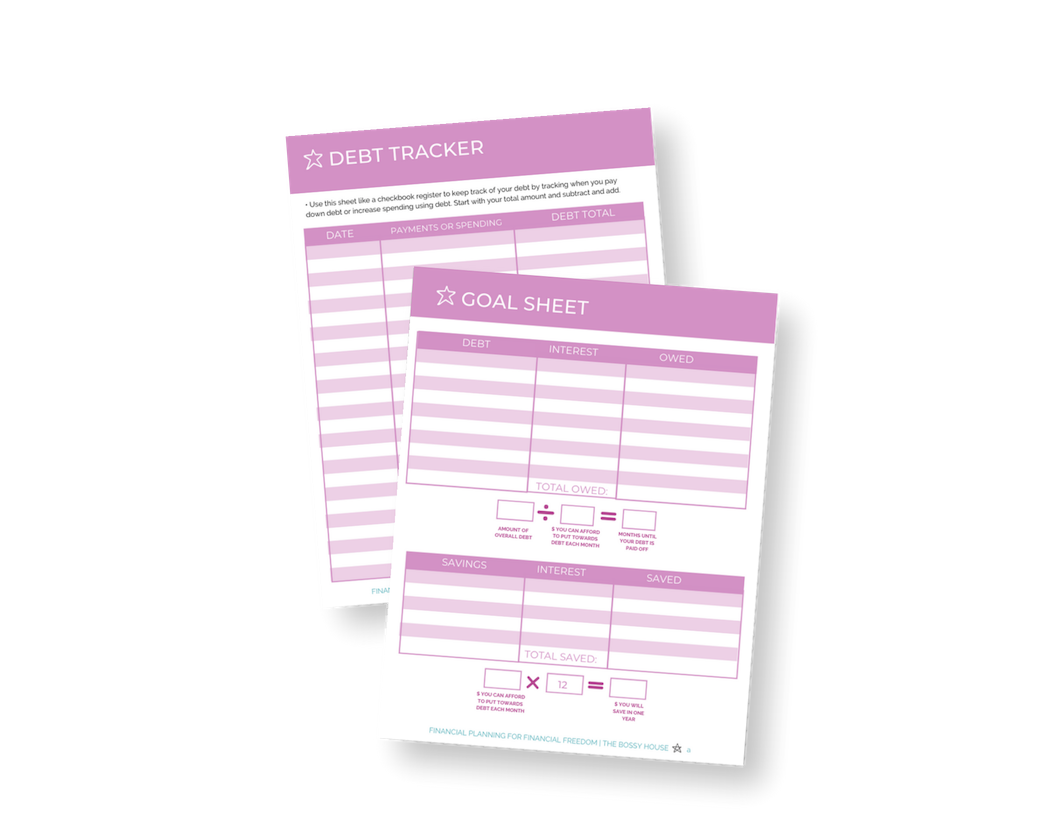

This set includes the goal sheet, debt and savings tracker, weekly spending worksheet, annual expenses planning sheet, as well as a budget summary sheet.

The most important first step if you're creating a personal financial plan is honesty. Not surprising, but a lot of us have a hard time being honest about our finances, and it's holding us back from living with real integrity.

Do you struggle each month to meet your financial obligations AND your goals?

Does your bank account or your budget SAY you should be able to contribute to savings and retirement, but you just can't seem to build those accounts? Are you in debt and aren't paying it off?

Tammy Lally says that unpaid debt is a sign you haven't completely forgiven your past. At the very least, unpaid high interest debt is a sign that your past purchases (most of which you've long forgotten about) are hanging around costing you interest.

It's time to deal with that so you can mentally move forward.

Getting honest about your financial situation is the first step to success, and it's the only way you can begin with integrity.

I suspect one major reason we don't get honest is because LOOKING at our financial situation means we have to actually DO something about it.

And doing something about it means __________________.

Fill in the blank, and you might discover why it's so hard for YOU to look honestly at your finances.

Does it mean you'll have to stop overspending? Does it mean that you'll have to come to terms with how LONG you'll be paying that credit card off at the rate you're going? Does it mean you'll have to live within your means?

Though painful, it's important that we stop lying to ourselves and get really real about our finances. There's just no other way to do this.

Don't get all your bills and a calculator out and start fussing at yourself for overspending. Yet.

The first step is looking at how well you are meeting your goals to pay down debt, build savings, and save for retirement.

Why do we start with these items?

First, it doesn't make sense to berate yourself for using the money you make to buy lattes and concert tickets unless it's a real problem. If you have no unpaid debt and you have a healthy savings and retirement, spend away!

To start making judgements about how to move forward, we have to find out your actual situation. The health of your savings and debt is a good sign of what goals you should have. Only then can you evaluate whether you are making the best effort at meeting those goals.

First step, calculate how much high interest debt you have. Include the interest that is charged and the amount you owe.

Then, add up how much money you have saved. Depending on your situation, this could include savings accounts as well as retirement accounts. I'm not dispensing advice about retirement here. I'm mostly just lumping it into the savings category but suffice it to say you should be building a retirement account as well as a personal savings account.

It's now time to look honestly at your debt and assess the reason behind the debt you have. Being able to afford large purchases that you couldn't afford otherwise is a fine way to use low-interest credit, and these usually include home renovation, car payments, and a mortgage.

If you are using credit cards to finance your regular life (as in clothing and dinners out and vacations) you are not being honest with yourself about how much money you actually have to spend on life. You are pretending you have more money to spend than you do.

Make a mental note about all the things you purchased with this debt. Are these large purchases or are they convenience purchases?

Now is the time to pledge to stop using your credit cards for any of the reasons above. I'm not saying cancel them-- doing that can have consequences for your credit.

But if you're serious about taking charge of your financial situation, you will stop using your cards and create a plan that has integrity and honesty.

These are the main goals of any plan. If you haven't been honest with yourself about your finances, chances are you're not doing all four of these items and it's having a bad effect on you.

If it's time for you to take the first steps and I can help!

Download my financial planning templates below and get ready to start making plans for your financial future!

Session expired

Please log in again. The login page will open in a new tab. After logging in you can close it and return to this page.