THIS POST MIGHT CONTAIN AFFILIATE LINKS. MY DISCLOSURE POLICY GIVES YOU MORE DETAILS.

It's time to take charge of your money.

If you think about paying your bills when your bills arrive, as in your bills remind you to pay them, YOU ARE IN TROUBLE.

You are thinking about your bills as the driver of the activity, which is making the bills the boss of you.

You need to boss your bills, and I'll show you how to do it so you take charge of your money management system!

Winging it costs you money

What do many people do? They wing it. But winging it feels TERRIBLE. It feels like SO MUCH WORK. Don't think so?

Maybe this sounds familiar:

October 1: get paid. FEEL RICH!!

• You remember your mortgage is $1200. But besides that you have no idea which bills HAVE to be paid between October 1 and October 15 when you get paid again.

• You go out and buy a bunch of stuff, eat out a bunch of times, and generally don’t pay attention to your spending.

• When you see the light bill is due Oct 12, you think “Well, it might have to wait until the 15th because I paid the mortgage and bought all that stuff, and now that I look at my account I only have $600 and this bill is $100 and I think I’ll need that $600 for basic groceries and stuff until Oct 15.

• You THEN tell yourself “if it’s two days late they probably won’t give me a late fee.”

• THEN, you tell yourself “I’ll remember to go pay this bill on October 15th.”

October 15th rolls around thank god!

• You didn’t buy groceries last week because you couldn’t afford them, so as soon as that paycheck arrives you buy groceries. And some new pants and you eat out again a bunch of times.

• Then, you remember you have to pay the light bill. You get out your checkbook, and you send a check for the money because you know it’s in your account right now. You mail the bill.

•was It arrives on October 22nd. Now it’s 10 days late and you’re charged a $30 late fee, so next month’s bill is going to be $130.

• You say to yourself “I told myself that I’d send some money to debt.” You look in your bank account and you have $900 until November 1. You say “ I think I’ll send $500 to debt this month (yay me!)” BUT … you forgot about that check for $100 and now you only have $300 until November 1st.

• Meanwhile a check from LAST MONTH that was never cashed comes through and now you're broke and two items bounce so your account is overdrawn and you owe the bank $40 for bounced check charges.

• On October 25th you go to buy a halloween costume but you have to put it on the card because you need that money in your bank account to pay for groceries and gas for the next week.

AHHH THiS IS NOT THE RIGHT WAY TO DO THIS.

Taking charge of your money can start today

You have to take charge of your money by setting up a system. A big-picture system that has you calendaring your bills, choosing which pay period to pay them, and knowing how much you typically spend in a week.

Just those two pieces of information can help you make great decisions about your money management, and I can walk you through it!

The first step is taking charge. Hopefully, this video will convince you it's time!

Get the template to clean up your finances

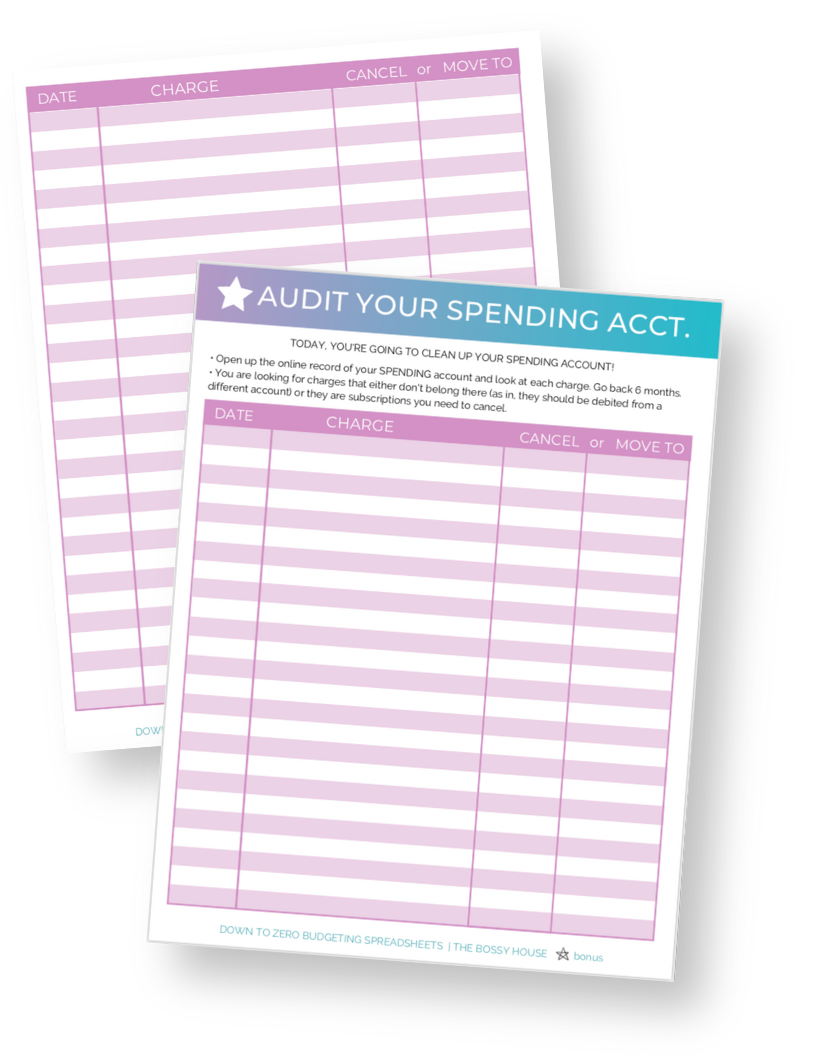

In the video I talk about auditing your account. Use this Audit Your Account template to organize the audit process.

When I'm done taking notes in my bank account, finding all the different charges I need to investigate, I use this sheet as a to-do list for the next period of time.

Check out the templates below for set of calendars so you can make a plan with your bills and never again be surprised!

RELATED: Make a Down to Zero Budget

In no time, you'll be ready for advanced-level financial planning that has you paying your bills, saving for the future, and getting free of financial worry. I know you can do it!

Get this set of financial planning templates to get started on your budget journey!